The art and science of raising capital.

Alternative investment opportunities for sophisticated investors.

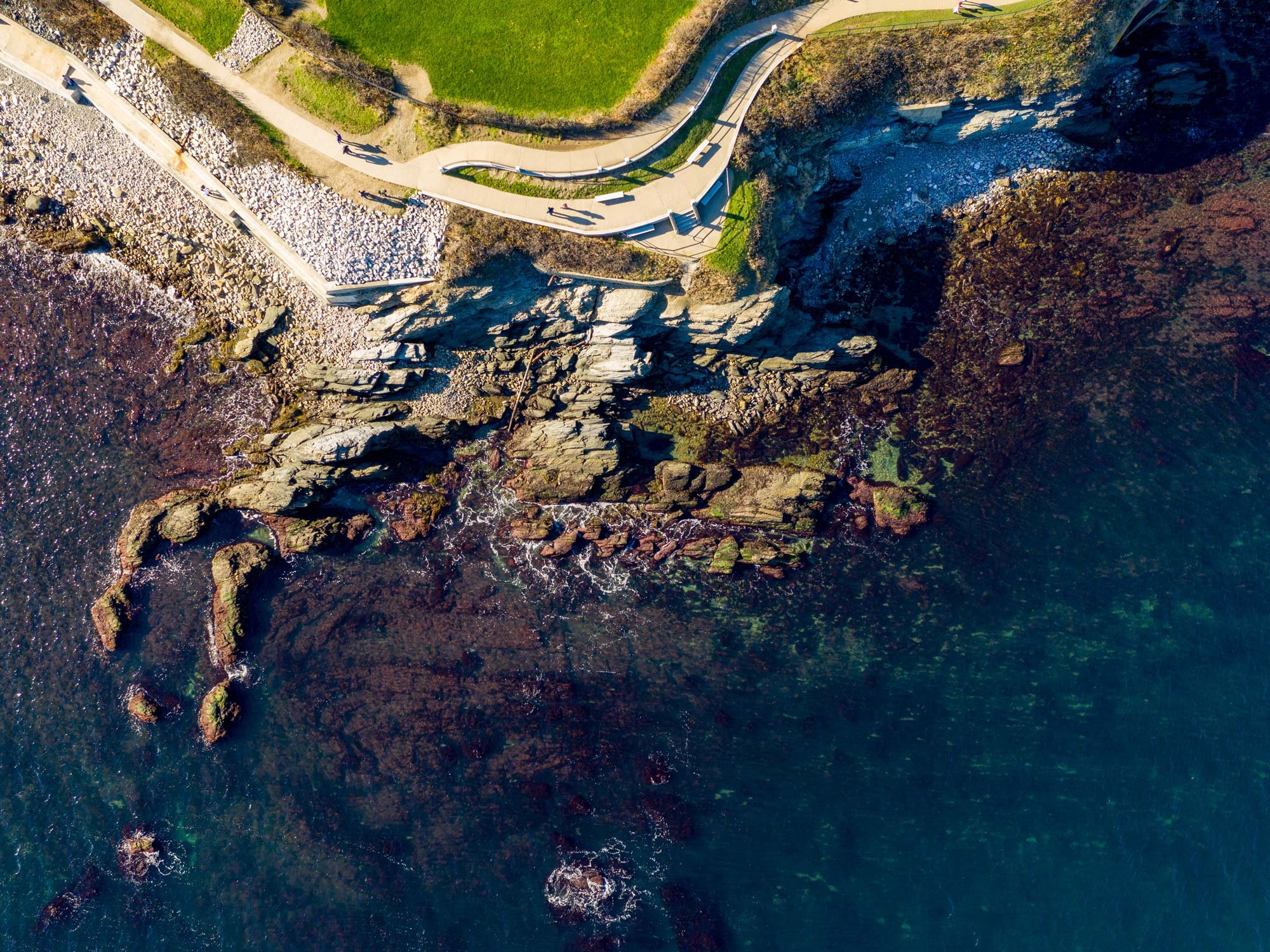

The Castle Hill Way

-

Process Driven Approach

Castle Hill Capital Partners is a strategic marketing and capital raising firm that deploys a process driven approach to raising capital for alternative investment strategies and private placements.

-

Profound Investor Relationships

The team has long-standing relationships with sophisticated institutional investors including family offices, endowments, foundations and pension funds. The team has built a strong reputation by listening first, talking second and acting with integrity and respect at all times.

-

Creative Program Implementation

Every client requires a customized marketing program that navigates the headwinds and leverages the tailwinds on a particular team or strategy. Castle Hill exhaustively reviews and then creatively implements our programs targeting the appropriate investor, with the right message at the right time.

-

Exceptional Clients

Castle Hill only works with asset management firms that have a credible, sustainable, competitive advantage; operate with the highest standards of integrity and ethics; and communicate transparently and directly with their clients.

Focus where we can add tremendous value

-

Liquid Strategies

Hedge Funds, CTAs

-

Illiquid Strategies

Private Equity, Venture Capital & Real Assets

-

Private Placements

Private Companies & Real Estate

-

Liquidity Solutions

Hedge Fund, Private Equity Positions & Pre-IPO Shares

Partner with experienced professionals

We visualise the goal, craft a plan, put in the work, execute and then celebrate our clients’ success…together.